Delivery dates December 2021/January 2022

Salary December 2021

In order to ensure that the payroll for the month of December 2021 and/or period 2021-13 is processed before Christmas, we would like to ask you to deliver any changes for this period no later than December 15th 2021. For questions or more information, please contact your usual salary consultant.

Salary changes and mutations January 2022

Given the many legislative changes in 2022, the processing time in the month of January 2022 can be longer than you are used to. We kindly ask you to deliver the January 2022 mutations as soon as possible. Should this be a problem, please contact your usual salary consultant.

Decision / notification “Werkhervattingskas” 2022

For a correct payment of premiums to the tax authorities, we need the Whk percentage stated on the decision / notification “Werkhervattingskas” 2022. We request that you send a copy of this decision / notification to your salary adviser as soon as possible. You’ll receive this notification in December 2021 from the DTA.

Work-related costs scheme (WRC) 2021

As you may know, any settlement of the WRC for the year 2021 must be included in the payroll tax return for the month of February 2022 at the latest, payable before March 31st 2022. This settlement partly consists of items arising from the payroll administration and items arising from the financial administration. Should you take action?

We have identified the items arising from the payroll records, but we do not know whether there are any items in the 2021 financial records that fall under the WRC free allowance. We would like to ask you to let us know, before February 10th 2022, if there are items in the 2021 financial administration, and for what amount, that fall under the free margin of the WRC. For example, the costs of a staff party, Christmas gifts, a flower during illness (above € 25.00 including VAT), gym subscriptions, etc.

Care bonus:

If you have applied for the so-called care bonus for your employees, we advise you to have a WRC scan carried out. Please contact your salary consultant about this.

If we have not received a response from you by February 28th 2022, we will assume that you have established that the tax-free margin has not been exceeded.

Minimum wage January 1st 2022

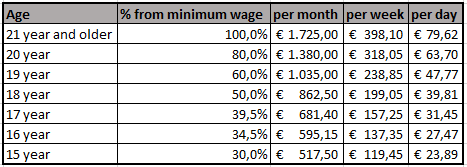

From July 1st 2019, every employee aged 21 and over is entitled to the full statutory minimum wage.

The amounts of the statutory minimum wage apply to a full working week. Below are the amounts for the minimum wage as of January 1st 2022.

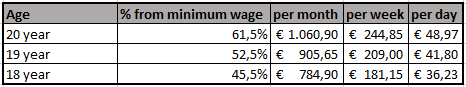

Below are the gross amounts for the minimum wage for apprentices who work via the Professional Guided Learning (BBL) pathway. These amounts apply as of January 1st 2022.

Important changes 2022 Dutch Payroll

Below we have listed important changes for 2022 regarding the Dutch Payroll, via the button below you can read more about these changes.

Important changes 2022 Dutch Payroll

WAZO benefit:

As of January 1, 2022, it is mandatory that WAZO benefits (maternity leave benefit, supplementary birth leave, adoption and foster care benefit, illness due to organ donation, illness due to pregnancy) are declared on a new income ratio number in the payroll and wage tax return. It is therefore necessary that you always inform us when you receive a benefit from the UWV for an employee, even when the benefit is paid to the employee directly because this will have to be processed through the Dutch payroll as well.

Working from home allowance / (fixed) traveling allowance

The working from home allowance is intended to compensate for the additional costs that an employee incurs due to working from home, for example the costs of heating and coffee. The working from home allowance can amount to (a maximum of) € 2,- per day, can be paid out untaxed and is considered to be a so called “targeted exemption”.

The working from home allowance cannot be paid together with a traveling allowance on days when the employee works both at home and at the company. A choice must then be made as to which allowance will be provided.

Currently, a tax free fixed allowance for commuting can be provided based on 214 days worked if at least 128 days in a year are spent traveling to work. If the employee travels to the fixed workplace on less than 128 days per year, a fixed monthly travel allowance is not possible. Travel expenses must then be claimed periodically.

Employers must keep track of and report to us on how many days employees work from home, and on how many days they travel to their fixed place of work.

If you have employees who live and/or work outside the Netherlands and work (partly) from home, please contact us.

Differentiated premium Aof (disability premium)

As of 2022 a differentiated premium percentage will also apply for the WAO/WIA (disability benefit).

Whether the low or high contribution rate applies to you is indicated on the decision / notification with the differentiated contribution rates for the WAO/WIA.

Suspension of increased contribution unemployment premium in the event of more than 30% overtime

Since 1 January 2020, employers have been paying a low WW (unemployment benefit premium) contribution for permanent contracts and a high WW (unemployment benefit premium) contribution for flexible contracts. An important note in this regard is that the high contribution also applies retroactively to permanent contracts if the employee has worked more than 30% overtime in a calendar year. During the corona crisis, the government temporarily suspended this rule. As of January 1st 2022, the 30% cap will again apply to all employees (except for those who with a fixed contract for 35 hours per week).

Work-related costs scheme (WRC) 2022

The Work-related Costs Regulation (WKR) is mandatory for all employers. The WRC allows you to spend a portion of your total taxable income (the free margin) on untaxed compensation, benefits in kind and provisions for your employees.

How does the WRC work?

You do not pay payroll tax over the allowances who fall within the free margin. Over the amount above the free margin you pay payroll tax in the form of a final levy.

Exemptions

You can freely reimburse, provide or make available certain items to your employees. This applies, for example, to travel expenses, telephones or computers. You can do this by means of targeted exemptions and nil valuations. These are not at the expense of your free margin.

What will change?

Do you have employees? You can give your employees untaxed compensation thanks to the work-related costs scheme (WRC). You may also reimburse something from which your employees could benefit privately. For example, a sports subscription or Christmas gift. In 2022, you may give untaxed compensation up to 1.7% of the first € 400,000 of the wage bill (the wages of all employees combined), plus 1.18% of the wage bill above € 400,000. This is the free margin.

The increased free margin of 2020 and 2021 expires in 2022.

Current news items

Are you interested in current news items that may affect your HR or payroll administration? Then sign up for free via our Smart HR Portal.

Insights into your administration over 2021

If you use Nmbrs, you will be able to download your annual report in File Management from mid-February 2022. If you would like to know more about this, please contact your advisor.