Introduction

In our earlier Tax Alert we discussed the amendment as of January 1st 2022 with regard to the unilateral application of the Dutch at arm’s length principle for intercompany transactions in cross-border situations. Since the implementation of one of these provisions (article 8bd CITA), questions were raised on its impact, in particular to certain structures for which the provisions were not designed. In the Decree of January 11, 2023, the Dutch State Secretary of Finance has now (partially) provided clarification.

Issue

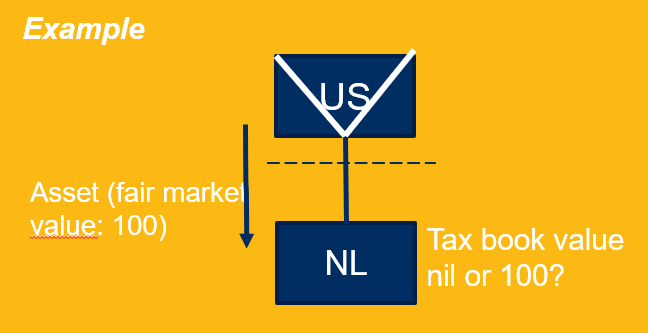

Article 8bd CITA aims to prevent double non-taxation as a result of a valuation difference between an intercompany transfer of assets by means of a capital contribution, profit distribution, return of paid-up capital, liquidation payment or a similar transfer.

Based on the literal interpretation of this provision, the limitation also applies in case the affiliated entity is subjectively exempt from a profit tax or is resident of a state where the company is not subject to a profit tax (Non-Profit Tax State). This is i.a. the case in case the affiliated entity is a disregarded entity or a Pension Fund. As a result, the acquired asset(s) should be capitalized on the balance sheet of the Dutch entity for € nil and consequently cannot be depreciated for tax purposes.

Decree

The Decree clarifies that article 8bd CITA does not apply if the affiliated entity is subjectively exempt from a profit tax or is resident of a Non-Profit Tax State), if the fair market value of the asset is reflected in both the civil law documentation of the transfer and in the annual accounts of both the transferor and the Dutch company.

To do

Multinational companies should verify that its cross border capital contributions and distributions are sufficiently reflected in legal and financial documentation.

Questions

If you have any questions, please contact: